Managing Your Online Services Costs

This post is about personal online services we use in our everyday lives. Looking at those expenses isn't a new thing for me, but I do not recall handling this in a systematic manner until today.

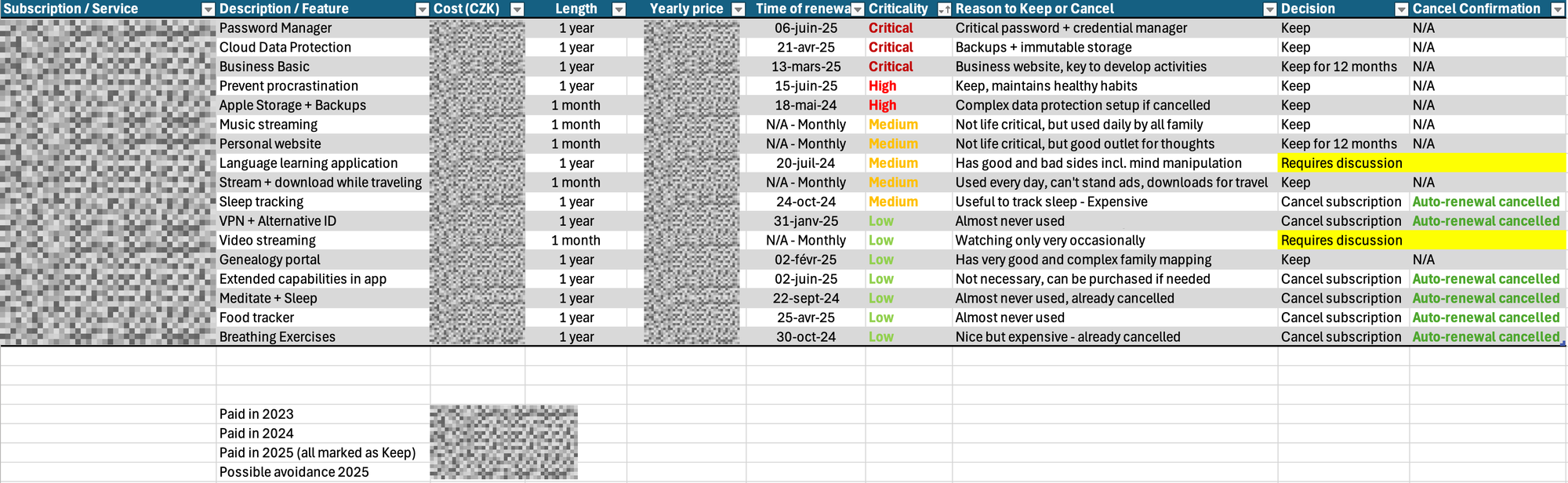

By systematic, I mean having a comprehensive tracker which exhaustively lists every single online service and subscription that is charged on a regular basis, be it monthly, quarterly, yearly, or more. This also includes tracking yearly cost for monthly or quarterly based services, having a clear view of renewal dates, and a rationale to why the service must be extended.

I have to thank my community friend Chris Kranz for a post on LinkedIn that recently referred to that topic. It had me look deeper into what I had already done and gave me inspiration to bring it to a more systematic level, with this article as an ancillary outcome.

Why track your online spend?

Well, very simply because it costs money today to consume online services, and the friction is very low: you're usually one FaceID away from making a purchase, and all services are set by default to auto-renewal.

Low charges (usually below $10 for monthly services) give us the false impression that those expenses are irrelevant and that "we can afford it", however the reality is that not only these charges add up, but also multiply by the number of months you are subscribed.

I encourage you to do the math and perhaps you will be surprised. I will show you later how I proceed, so keep going on.

Be ruthless

I'm the kind of person who tends to show sometimes too much empathy, thinking about the social consequences of not renewing: will the dev / founder will be sad? Will people lose their job? It's all too easy to get dragged into these considerations and rethink whether we should cancel or not.

However, the reality is that we are the only ones responsible for our money, i.e. how we earn it and spend it. We should always look at our expenses with a cost vs. value prism. Is this subscription critical for me? Does the value far outweigh the cost?

For example, the value of paying for a password manager or a data protection service is usually high (I ranked these services as Critical in my tracker): what would happen if I lose my passwords or my data, or if these are compromised? What is the time and effort saved?

On the opposite, an in-game subscription is bringing me a temporary sense of gratification: I now have that not-so-huge amount of in-game currency, my FOMO is calmed, but in 30 minutes the feeling of gratification will fade and I will be short of $20 for what was only a temporary boost of dopamine.

Eliminate the unnecessary from your life

That's why my motto here is: be ruthless. Unless the service has high value for you, no need to keep it: go ahead and cancel it straight. In the Apple ecosystem, you can keep using it for the duration you paid: a month, a quarter, a year. If you see that in the meantime that subscription brings you tremendous value, you can always subscribe once again afterwards.

Discipline

Being ruthless when cutting with expenses is good, but starting with discipline is even better. The question to ask ourselves every time, even before doing a purchase (be it for a subscription or tangible physical goods) remains always the same:

Do I need this, and what is the value I'm getting out of it?

If you don't think you need this, or if you cannot clearly and simply articulate the value you should get out of it, then you should just put your purchase off.

Asking this yourself every time will prove very helpful in your life. This is not just about online subscriptions, but about pretty much everything else.

Here's a fresh anecdote: I was out of my plane from Las Vegas to Frankfurt yesterday, and walked as fast as I could to my next gate for the last leg of this trip (going to Prague). As I waited and waited for boarding, I felt an urge to grab a snack at the nearby shop, but when I looked at the options, there wasn't really anything good for me. Neither good in terms of form factor (sandwiches, snacks), or actual nutritional value.

Did I really need a snack? I wasn't that hungry. And what value would I get out of it? None, except stuffing myself with highly caloric, low nutritional stuff. I could certainly wait for roughly two hours to get home and prepare myself a decent meal. I also got a bottle of water and a small piece of chocolate on the plane, so offsetting a purchase is sometimes the right thing to do.

How I proceed

People who know me also know I have an Excel file for pretty much every single thing. So no surprise here, when I knew what I wanted to achieve I fired up Excel and created a spreadsheet to do two things:

- Track all my subscriptions, their costs, renewal dates, criticality, and value

- Add a cost avoidance tracker

The tracker itself isn't very complicated to set up, as can be seen on the picture below. I have also included a view of what I spent in 2023, what I paid or will pay by end of 2024, and what I expect to pay in 2025, with a view of the cost avoidance by cancelling some of the services.

I find it really important to articulate the rationale for keeping or cancelling a subscription. It's not only a matter of cost, but impact on your everyday life: is this a time eater or a life helper?

The cost avoidance tracker is something that came to my mind this morning: many times I'm offsetting a purchase, but never really tracking the impact of my decisions.

What I thought is "What if I would take the money from every cost avoidance and put it in a savings account?" The goal is obviously to estimate on the long run the financial impact of our spending decisions.

As a last activity, it's worth looking at all of your apps on your devices, since you may run into a service that doesn't directly uses Apple or Google subscription mechanisms. Also check your emails for upcoming service updates, for example I thought of at least two additional services that I forgot to include as I was finalizing this article.

Conclusion

These principles and systematic analysis of expenses can be applied to other areas, whether for everyday grocery / service purchases, for business expenses, and certainly apply to the business world as well.

Keep in mind that your mileage may vary: what is critical to me may be futile for you. That genealogy service I pay for gives me a lot of value, but may be meaningless to you. Similarly, you may need to pay five streaming services concurrently to keep peace in your family, while I am contemplating every month to get rid of Netflix.

What matters here is understanding what you are paying for, what is the footprint of your online spend, and making sure you have a clear overview and control upon where your money goes.

With that, happy tracking!